DETERMINE YOUR INCOME

Please complete the form below to help us determine whether or not you are eligible for a subsidy through Covered California. Please note any fields marked with an * are required.

**PLEASE NOTE: If you are married, you must file your taxes as

Married Filing Jointly to qualify for a subsidy. If you file as Married Filing Separately, you WILL NOT qualify for any subsidy amount.

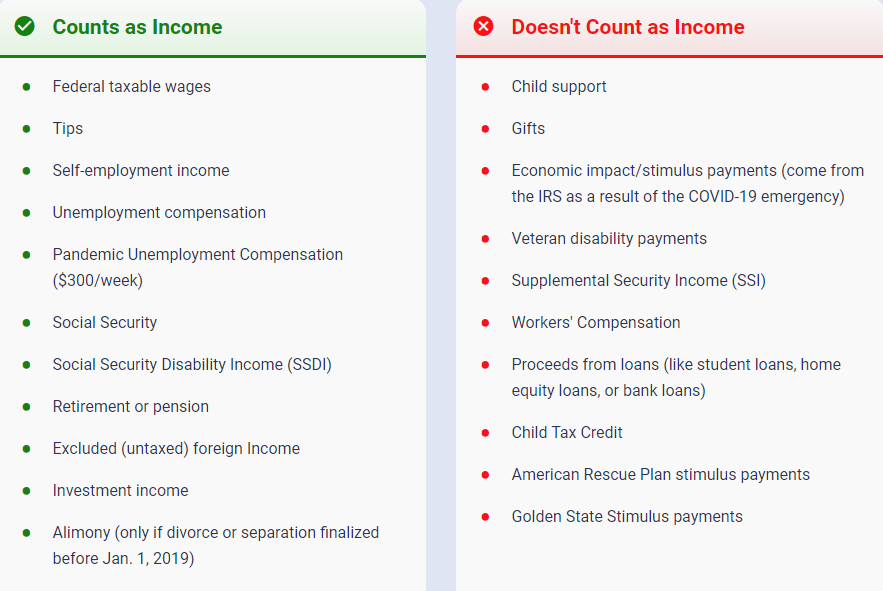

What Counts as Income?

In order to determine how much financial help you can get, you will need to estimate your household income for the current year.

Include income from anyone you claim on your taxes.

If you think your income may change in the future and aren’t sure how much costs are going to change, click on the Shop & Compare link below:

Shop & Compare Health Insurance Plans | Covered California™

**If your estimated income changes during the year,

please be sure to update your Covered California account accordingly.**

What Counts as Income instructions are current as of 07/17/2024.

Frequently Asked Questions

- What is Gross Taxable Income?

Gross Taxable Income is your Adjusted Gross Income that appears on Line 11, Page 1, of your Federal tax return, plus the total income for everyone in your household after any deductions. If unsure of this number, please confirm with your Accountant or CPA. - What if I’m self-employed and my income may change?

You should make your best guess of what you expect your income to be. Then, revisit mid-year, and adjust accordingly by updating your income on Covered California’s website. Doing this may help you to avoid having to pay back some of your subsidy. - If my income changes throughout the year, will my subsidy change?

It may, depending on several circumstances, but any time throughout the year you can update your income and visit the “Shop and Compare” page to see how you may be impacted.